Back in July, the Department of State issued its annual report on Nonimmigrant Visa Issuances by Visa Class and Nationality, and the F-1 student visa data was overwhelmingly positive. Visa issued numbers are largely back to the pre-pandemic normal, helped by record-high approval rates.

F-1 Student Visas Issued Return to 2019 Levels

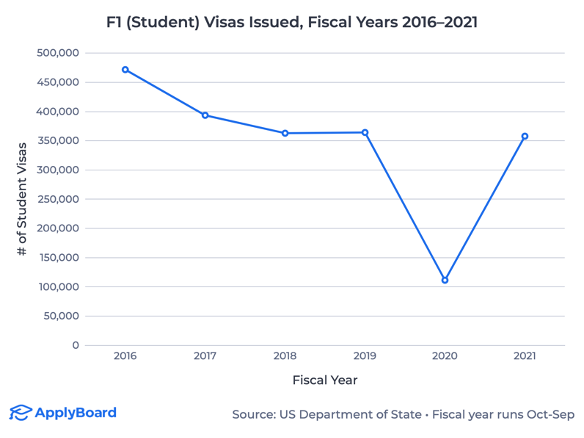

According to the new data, the US Department of State issued nearly 358,000 F-1 student visas in the 2021 fiscal year, which ran from October 2020 to September 2021. This was largely in line with totals from FY2018 and 2019, and represented a huge bounce back from 2020, when embassy closures, border restrictions, and pandemic uncertainty led to just over 111,000 visas issued.

The chart below shows the trend since FY2016:

While the US remains well off its high water mark of over 644,000 F-1 student visas issued in FY2015, these numbers should dispel any lingering fears that the US was in for a multi-year slump.

It’s worth noting, however, that competing destination markets have also bounced back considerably. The Canadian government issued more than 336,000 study permits itself in 2021, a 34% improvement over 2019.[1] And the UK not only experienced no international enrollment downturn during the pandemic, but also hit its 2030 international student population target nine years early.[2]

F-1 Student Visa Approval Rates Hit Nine-Year High

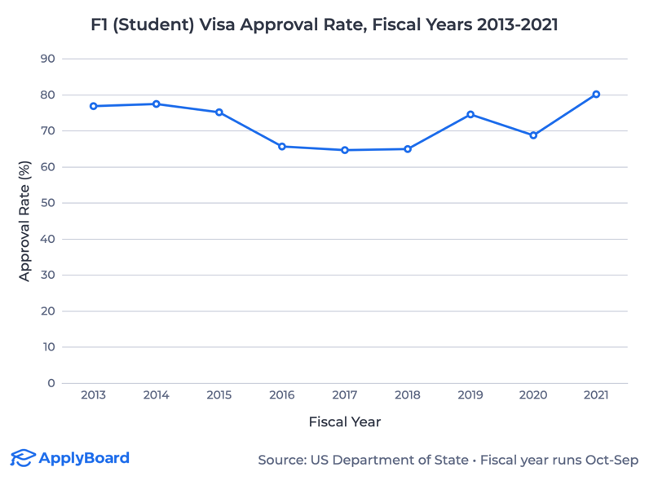

The recovery of the US F-1 student visa numbers has been helped by a notable rise in approval rates. After falling below 70% in FY2020, the F-1 student visa approval rate hit 80.2% in FY2021.

The chart below shows the change over the last nine years:

The rise in approval rate may reflect a concerted effort by the US government to bring students back to the US after competing destination markets have grown in recent years. Of particular note, this is well above Canada’s rate of 60% in 2021. Institutions should consider highlighting to prospective students their significantly higher chances of getting approved to study in the US than its neighbour to the north.

It’s worth noting that despite these numbers, agent perceptions of approval rates in the US remain poor, perhaps because agents are conflating approval rates with limited visa appointment availability and long wait times.

South Asian Markets Drive F-1 Student Visa Surge

South Asian markets were key drivers of the F-1 student visa surge. In fact, the four countries that saw the largest increase in F-1 student visas issued from FY2019 to 2021[3] were all South Asian.

The table below shows the top 10:

Bangladesh and Pakistan were markets that declined minimally during COVID, setting them up as prime candidates to grow post-pandemic. Both countries hit 20-year highs in F-1 student visas issued.

Nepal is a top-three source market for Australian institutions, and the US likely benefited from the extended border closures Down Under pushing students to explore other destinations. There’s some evidence that the US could retain its Nepali gains, however. As recently as 2016, the Department of State issued nearly 6,000 F-1 student visas to Nepalis.

India’s growth leaves it well positioned to surpass China as the top source country for US institutions. The chart below shows the trajectories of India and China:

The Department of State actually issued more F-1 student visas to Indian students than Chinese students in 2020, and while China surpassed India again in 2021, the margin was less than 10,000 students—a far cry from the 60,000-plus differential in 2019. With India primed to surpass China in population within the next year, it’s a trend that could accelerate.

East Asian Markets Lag in F-1 Student Visas Issued

China is not the only East Asian market to lag behind its 2019 total for F-1 student visas issued. Japan, South Korea, Hong Kong, and Taiwan all posted below-average numbers for FY2021.

The table below breaks down the bottom 10:[4]

East (and Southeast) Asian student numbers have been slower to recover across destination markets, perhaps due to a reluctance among parents to send their children abroad in the aftermath of a global pandemic. As COVID-19 slides further into the rear view mirror, look for these numbers to creep up.

Less optimism surrounds Saudi Arabia. Saudi F-1 student visa issued numbers remained down nearly 60% from 2019 and more than 85% since FY2014, after which the Saudi government tightened eligibility requirements for the popular King Abdullah Scholarship Program.

Key Takeaways

While F-1 student visa numbers remain well off their FY2015 peak, the return to 2018 and 2019 levels is extremely good news for institutions. The demand for an American education remains robust around the world, particularly in South Asia, where the US’s rising F-1 student visa approval rates are a key selling point and compare favourably with other destination markets. While the numbers out of East Asia are less encouraging, sector insiders should remain confident that these markets will continue to recover—though China’s days as the leading source market for US institutions are likely numbered.